Making a Submission to HMRC

Important: Making a submission locks transactions so they cannot be re-used. This is not reversible. Please do not make a submission unless you are sure that the transactions to be used are the correct ones, as this cannot be undone.

Once all data errors are cleared, you can make a submission to HMRC:

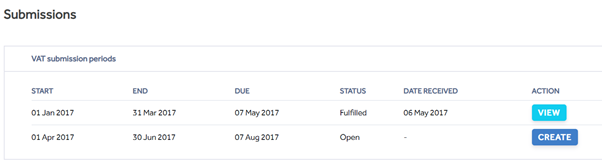

- Return to the Submissions screen and select the Submission period desired.

- Accept the confirmation to recalculate the 9-box based on the latest data.

- If you are happy with the 9-box data, click the Submit button.

- A message appears containing a legal statement from HMRC. Please read and understand it before clicking Accept and Submit. If you do not agree with the statement in this message, click Cancel.

Disclaimer: K3 Business Technologies and its agents or affiliates accept no responsibility for the content or calculation of any return filed. It is solely the responsibility of the user filing the return to confirm the completeness and correctness of any information sent to HMRC.

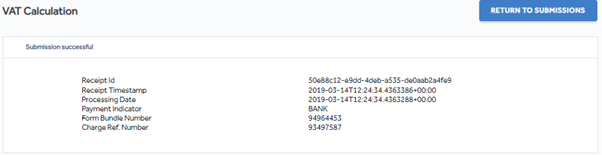

- When you click Accept and Submit, the Digital VAT app returns a successful submission message:

- The submission Receipt ID is stored in the app for all the transactions that made up that submission.

- If you are using an ERP connector that enables retrieval of submission data from the Digital VAT app, you can now pull this submission data back to the ERP system using the job as described in your ERP How-To guide.

- Press the Return to Submissions button. The Submission line now shows the Receipt Date on which the submission was made, and the submission Status is set to Fulfilled.

Your VAT submission is now complete.